How Can Tax Technology Help Increase Efficiencies And Improve Company Performance?

Share This Post

Companies must increase operational efficiency and performance in today’s fast-paced business climate. Tax technology can benefit firms. Companies may decrease errors, and costs. Get tax compliance insights by using the newest tax technology solutions. Tax technology can help firms stay ahead of regulatory changes and improve financial performance. This blog will discuss how tax technology may improve business performance by emphasizing essential tools and tactics that organizations can use to optimize their tax operations.

Global tax teams face changing reporting and regulatory paradigms in a competitive environment. Tax functions must collaborate with finance to digitize their operational models to modernize their enterprises. Technology integrating tax and finance departments can help firms engage tax in wider decision-making processes in real time, enhancing their chances of success in an unpredictable future

Also Read: Benefits of an Effective Workflow Automation Platform

Why a Technological Plan Should Combine Tax and Finance

Technology roadmaps can link tax and finance to revolutionize business

Despite budget cuts, companies are investing in tax technology transformation. According to the EY 2021 CEO Imperative Study, 61% of organizations say their tax department strategies now focus on data investment. The EY 2022 Global Tax Technology and Transformation Survey Report (pdf) found that 84% of organizations plan to invest $2 million or more in tax technology, with an average of $3.6 million over three years.

Most tax and finance departments want to get more value from their investments in tax technology.

Click on the circles to find out more about the investments and tactics.

A recent report shows that only a small percentage of tax functions extensively use advanced tax technologies, such as automation and cloud-based platforms. This is due to a lack of understanding, cost, and external pressure to commit to new systems. However, with the changes to international taxation, such as BEPS 2.0, processing a large volume of data is beyond the scope of existing systems. Advanced tax technology reduces risks and creates a single source of truth, adding tremendous value to companies. 44% of study respondents say the lack of a sustainable data and technology plan is the main obstacle to their tax and finance vision, making a tax technology strategy and roadmap essential.

Problems that keep tax and finance functions from achieving their goals and plans

Lee stresses the significance of a transformation roadmap or tax technology implementation strategy. It should be based on evidence, assess the current state and impact, and evaluate different solutions to support the business case. Since companies can now implement new systems in smaller chunks, roadmaps are even more important. If companies just address urgent difficulties without considering the bigger picture, this might cause issues.

For example, Campbell recalls automating processes for a company with 15 different business units. Where tax data was sourced from various places, creating complexity in transfer pricing. By asking where the data came from, Campbell’s team discovered. It all had the same origin, allowing them to create a single automated system with minor adjustments for each use case. This highlights the importance of a roadmap and understanding the data’s source. Before automating to avoid costly and inefficient processes.

A good technology roadmap can bring together tax and finance. So that they become a driving force in business transformation, producing an ecosystem of both new and old technologies that work well together. Using technology, tax processes can get more done with fewer people, reduce audit risk, and get to a single source of truth by making data sensitive. In a survey, 44% of people said that not having long-term plans for data and technology was the biggest obstacle to achieving their tax and financial goals. This shows how important a road map is.

Also Read: How To Pricing Accounting Services For Small Business Taxes

The Case for Aligning Tax and Finance

Tax and finance functions must align to leverage data to the maximum extent and greatest value

Taxation relies heavily on financial information, with companies paying taxes based on critical financial data such as profits and transaction values. To harness the full potential of advanced technologies such as data analytics, machine learning, artificial intelligence, and intelligent automation, this data needs to be democratized and made accessible at all levels, including end-users within the tax function.

With the increasing volume of data required for tax purposes, a siloed approach to data is no longer acceptable. A single source of truth is essential for ensuring process efficiency, data integrity, and supporting audits and inquiries. Tax authorities are now auditing companies by examining their source systems rather than relying on desk audits, making a single source of truth even more important.

To achieve this, organizations should consider investing in IT architecture. Such as data fabric and next-generation ERP systems like SAP S/4HANA. These investments will not only improve tax efficiency and accuracy. But will also create a foundation for broader digital transformation efforts across the organization.

New technologies can free, democratize, and maximize financial data for tax services. To maintain data integrity and facilitate tax authority audits and inquiries, companies must work holistically with data.

Data fabric and next-generation ERP systems like SAP S/4HANA can help. Tax functions can use EPM systems to condense data if an ERP transition isn’t viable.

Blockchain can also help tax functions. They can disintermediate and decentralize data exchanges, enabling fast and reliable data transfer. Blockchain can also improve supply chain data authenticity. By processing and recording customs, taxes, and other payments.

The EY 2022 Global Tax Technology and Transformation Survey finds that owners, boards, and C-suites increasingly perceive tax functions as strategic business partners. Tax and finance can provide real-time business insights as organizations use data as a strategic asset. This enhanced role emphasizes the need for a well-planned transformation roadmap that evaluates solutions, supports the business case, and considers evidence-based assessments of the current state and impact.

Chapter-3

Collaboration—Using ERP Deployments

ERP implementation often overlooks tax requirements

Tax regulations are typically disregarded during ERP system implementation, resulting in inefficiency and greater expenses for tax and finance teams. EY found that tax and finance teams must collaborate early on to include tax data in system deployment. Tax is “sensitized” early on, allowing teams to swiftly and strategically access tax information. Taxes should be included in planning to avoid data loss and higher repair expenses.

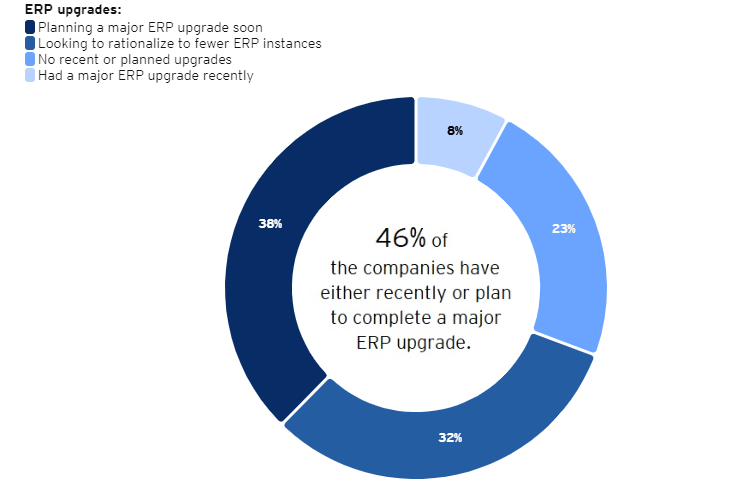

Tax staff can focus on business integration and tax planning by incorporating tax in the implementation. Phase to increase data quality and streamline tax operations. Companies may now comply with regulations and decrease risk using tax-specific ERP solutions. According to the EY 2022 Global Tax Technology and Transformation Survey Report. More than half of the respondents who upgraded their ERP in the past two years feel it was effective and delivered value.

Tax teams must be included in ERP upgrades, as over half of organizations have just completed or are planning one in the next two years. They can meet reporting obligations and quickly access tax data by doing so.

Campbell says that good contact between tax and finance is the key to success when putting in place an ERP system. Workshops, where both teams can talk about problems and find ways to make things better, can lead to “eureka moments” and better teamwork. For example, Finance may have always had data that could have met the tax team’s reporting needs, but if they hadn’t talked to each other, they wouldn’t have known.

Even though the idea of a cross-functional ERP transformation may seem scary, bringing in an outside advisor can be an efficient and cost-effective way to handle the work and provide knowledge. An outside expert can give advice on best practices, how to compare yourself to your peers, and how to advocate for taxes in the right way. Without someone who has done ERP financial transformations before, it can be hard to find risks and challenges and put best practices in place

Talent Competition Victory

Tax professionals need technology to handle rising workloads

Companies are realizing the necessity of hiring the right people as tax and finance activities become more integrated and technology advances. As workloads rise, tax agencies are having trouble hiring additional staff.

In the next three years, 95% of organizations expect their tax staff will need data, process, and technological skills to improve their tax technical capabilities. To prepare tax professionals for a fast-changing environment, a major investment in training and development programs is essential.

Companies expect their tax personnel will need to augment tax technical skills with data, process, and technology skills.

- Expected skills Extension:

- Very large extents

- Large Extents

- Medium Extents

- Low Extents

“It’s unreasonable to expect the whole tax profession, which already has a very difficult job, to become good at technology overnight.”

Albert Lee

EY Global Tax Technology and Transformation Leader and EY Asia Pacific Tax Technology and Transformation Leader

Another important thing to learn from this is that even though the focus is on automating data, skilled people are still very important to the process. It’s an example of tax pros working with the machines instead of trying to beat them. People should always be at the heart of any changes to finance and taxes.

Lee says, “You need people to put the strategy into action, to make the transformation plan and systems, and then to run it.” “It still takes judgment. And it still needs exception management. Human resources will be very important in all of these change projects because of this

Steps for Successful Transformation

Through a few key steps, the finance and tax functions must build agility and sustainability into their working model

To meet the needs of enterprise-wide transformation, CFOs are trying to change both tax and finance. Tasks to make them more efficient and easier to manage data sets. The most recent study from EY teams shows how important it is for tax and finance. Functions to work together better during this transformation process.

To achieve agility and sustainability, tax and finance functions should follow these key steps:

- Assess the current state against potential future impacts and conduct a gap analysis. Finance should understand tax needs and why they are important.

- Use powerful technology to handle the increased workload created by changing regulatory environments. Tax workers with the right skills should use both cutting-edge automated tools and a lot of data.

- Determine which working model—outsourcing, hybrid/co-sourcing, or in-house function redesign—best fits the strategy.

- Leverage enterprise systems to build a common, standardized data framework. This environment, which is called the “intelligent tax and finance function,” can support the whole process of getting tax and finance records ready to be reported.

- Build the ecosystem step by step, using the business technology stack and data models that are already in place to support use cases. This approach will enable continuous improvement and drive long-term value for the enterprise.

Conclusion

The world’s tax system is getting more complicated and competitive. The tax system is at a turning point. There is a risk for businesses to keep using the same ways of doing things. By getting closer to the financial world and being at the forefront of change, there are opportunities to be had. Here are some of the tools, tactics, and processes that will help a transformation go well.

Upgrade your company’s performance and efficiency with ProcessWurks, the game-changing tax technology solution. Save time and money with our user-friendly interface and powerful features. Choose the pricing option that suits you best.

If you are Looking for a lifetime solution? pay only once, and enjoy unlimited access. Take advantage of our limited-time offer and propel your company to new heights with ProcessWurks. Discover more about our pricing options and get started today!

Click Here to Learn More

Editors Choice:

- Content Marketing For Accounting Firms

- How can Accountants do Search Engine Optimization for their practice?

- How To Automate Accounting Processes

- Inbound Marketing Guide For Accountants

- How To Pricing Accounting Services For Small Business Taxes

- Social Media Marketing Tips for Accounting Firms

- From Clicks to Conversions: Your Complete Guide to Planning a Winning Facebook Campaign

- Secure Your Data with ProcessWurks SSL Encryption

Want to automate your firm? Try ProcessWurk free trial today

ONE Software to run your entire business. From Marketing to Sales to Client on-boarding to Client deliverables to Firm Operations

More To Explore